How Boards Shape Decision Accountability

Boards of directors play a critical role in ensuring accountability in organisational decision-making. Their responsibilities include setting oversight mechanisms, shaping leadership culture, and ensuring compliance with legal and ethical standards. Key findings from recent research reveal the following:

- Boards are legally bound by fiduciary duties under the Companies Act 2006: Duty of Care, Duty of Loyalty, and Duty of Obedience.

- Effective boards influence leadership behaviour by fostering open debate, reserving authority over key decisions, and holding CEOs accountable.

- Psychological safety within boards is essential for ethical decision-making, yet many boards lack this, leading to withheld information and flawed decisions.

- Trust in boards is declining, with 57% of executives believing boards fail to understand stakeholder concerns.

Boards must adopt structured accountability processes, such as CEO evaluations, post-decision reviews, and independent performance assessments. However, limitations like time constraints, dense documentation, and operational focus hinder effectiveness. Leaders should prioritise transparent, outcome-focused governance to rebuild trust and improve decision-making.

Governance Bites #80: board evaluations, with Paul Brown

sbb-itb-ce676ec

Research Findings on Board Effectiveness

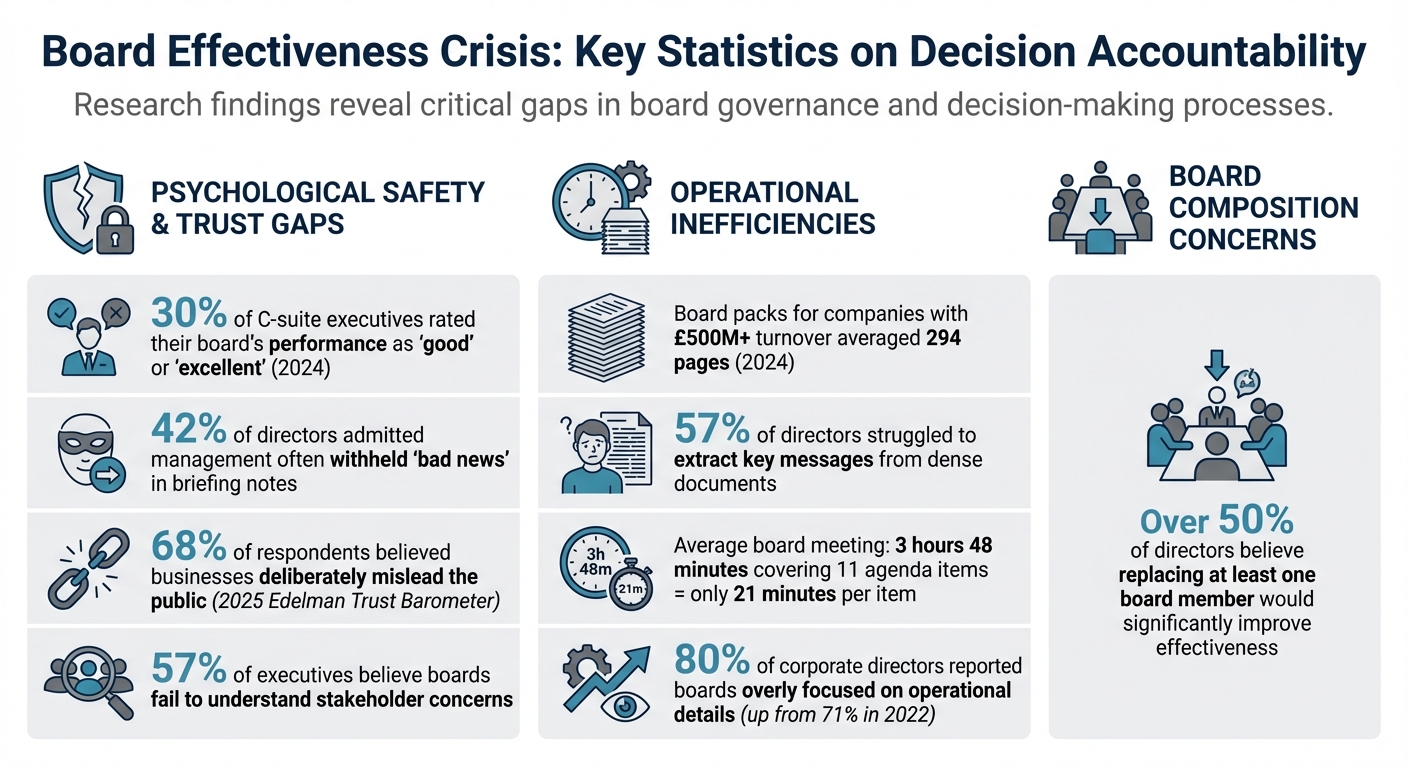

Board Effectiveness Crisis: Key Statistics on Decision Accountability and Governance Gaps

Psychological Safety and Ethical Decision-Making

Recent studies highlight a significant gap between how boards perceive their own effectiveness and how they actually perform. In 2024, only 30% of C-suite executives rated their board’s performance as "good" or "excellent", while 42% of directors admitted that management often withheld "bad news" in briefing notes. This disconnect is often linked to a lack of psychological safety - the kind of environment where directors feel confident challenging management without fear of repercussions.

The Post Office scandal, revisited during a 2024 public inquiry, serves as a stark example of the consequences of such shortcomings. The inquiry revealed that the board’s inability to encourage open dialogue and challenge technical assumptions contributed to two decades of false prosecutions. This failure underscores how a lack of psychological safety can lead to severe ethical lapses.

The issue of trust extends far beyond individual organisations. According to the 2025 Edelman Trust Barometer, 68% of respondents believed that businesses deliberately mislead the public. This erosion of trust reflects a broader issue within boardrooms, where procedural formalities - referred to as "high church rituals" - often overshadow meaningful debate. For instance, directors of companies with turnovers exceeding £500 million received board packs averaging 294 pages in 2024, requiring nearly two full days to review. Unsurprisingly, 57% of directors reported struggling to extract key messages from these overly dense documents. Such findings highlight how ineffective board processes can stifle decision-making and accountability.

CEO Accountability and Board Actions

Beyond the challenges of fostering psychological safety, boards also face criticism for their inability to hold CEOs accountable. Researchers have pointed to a trend of "fecklessness", where boards engage in prolonged discussions but fail to take decisive action against underperforming chief executives. In 2024, 80% of corporate directors reported that their boards were overly focused on operational details rather than broader strategic goals, up from 71% in 2022. This operational focus leaves insufficient time for the high-level oversight required to evaluate and hold CEOs accountable.

The lack of psychological safety further complicates these oversight efforts. For example, the average board meeting for companies with turnovers exceeding £100 million lasts 3 hours and 48 minutes, covering 11 agenda items. This allows only 21 minutes of discussion per item, making it difficult to thoroughly assess CEO performance. Moreover, over 50% of directors believe that replacing at least one board member would significantly improve overall effectiveness. These findings suggest that structural and cultural changes are critical for enhancing board accountability and decision-making.

How Boards Enforce Accountability

Effective boards rely on structured mechanisms to ensure accountability, both for their chief executives and for their own governance practices.

CEO Accountability Tools

Boards employ a range of formal tools to hold chief executives accountable. One key mechanism is the use of a schedule of reserved matters, which requires board approval for significant decisions. This ensures that executives cannot unilaterally commit the organisation to major actions without proper oversight and consultation.

Another critical tool is the design of remuneration structures. Boards implement malus and clawback provisions, which allow them to adjust or recover executive pay when performance falls short or misconduct occurs. These measures tie financial rewards directly to measurable outcomes, creating clear consequences for poor decision-making.

For particularly complex or high-stakes decisions, boards often turn to independent reports or specialised sub-committees to provide thorough scrutiny. Some boards even appoint a "devil's advocate" to challenge assumptions and counteract groupthink. As Charles Gurassa, Chair of Channel 4, puts it:

A high-quality performance pack is a really powerful tool that helps the board be much more effective, both as providers for shareholders and as supporters and constructive challengers of the strategy.

Boards also conduct post-decision reviews to evaluate the merits of their decisions and the effectiveness of the processes involved. These reviews create a feedback loop that not only improves future decision-making but also holds CEOs accountable for implementing agreed actions. Digital tools, such as decision logs and action trackers, further enhance this process by monitoring follow-through on commitments made during meetings.

Through these mechanisms, boards not only maintain control over executive actions but also set a precedent for holding themselves to similarly high standards.

Board Self-Accountability Processes

Boards are not exempt from scrutiny and must hold themselves accountable for the organisation's outcomes. Many FTSE 350 boards conduct independent performance reviews every three years, complemented by annual internal evaluations. These assessments help measure effectiveness, identify gaps in skills or knowledge, and ensure strategic alignment. Additionally, individual directors are typically appraised annually by the Chair, with their contributions measured against pre-defined criteria.

The Financial Reporting Council (FRC) has placed greater emphasis on outcome-based reporting, requiring boards to demonstrate tangible results from their decisions rather than merely outlining processes. This approach reinforces transparency, particularly under the "comply or explain" principle, which obliges boards to provide clear justifications when deviating from governance standards. As the FRC notes:

Transparency and accountability matter at every level. The quality of governance will be evident in the way the company conducts business.

Committees such as Audit, Risk, Remuneration, and Nomination play a key role in board accountability. These committees delve into specific issues, submitting detailed reports that summarise their discussions and provide assurance on delegated matters. UK Corporate Governance guidelines further require boards to monitor all material controls and issue an annual declaration on their effectiveness. This structured approach fosters continuous improvement and ensures that boards remain aligned with their governance responsibilities.

Governance Reforms and Stakeholder Accountability

Fiduciary Duties Beyond Shareholders

Under Section 172 of the UK Companies Act 2006, directors are legally required to promote the success of their company while considering the wider impact of their decisions on the community and the environment. This isn't a mere guideline - it's a binding duty that sits alongside their traditional responsibility to shareholders.

However, balancing these often-conflicting responsibilities can be a complex task. Researchers Andrew Keay and Joan Loughrey describe this tension as "multiple accountabilities disorder", which they argue creates confusion around board responsibilities. As they put it:

Without a clearer idea of the elusive concept of accountability, debates about board accountability may be at cross-purposes.

A recent example of this complexity was seen in 2023 when ClientEarth brought a derivative action against Shell's board for allegedly failing to manage climate-related risks. While the claim was ultimately dismissed, it underscored the growing expectation for boards to address broader societal and environmental concerns.

Societal and Environmental Accountability Trends

The scope of fiduciary duties has evolved, with boards increasingly being held accountable for addressing societal and environmental challenges. Tackling climate issues, for instance, is now considered a core responsibility. As Laurel Powers-Freeling, a Chapter Zero Fellow, explains:

Understanding the impact of climate change and addressing it is a fiduciary responsibility for NEDs, says Chapter Zero Fellow Laurel Powers-Freeling. So, they must own it.

The updated UK Corporate Governance Code 2024, effective from 5 November 2025, reinforces this shift. It requires boards to consider long-term trends, such as technological advancements and environmental and social factors, that influence sustainable success. This reflects a growing recognition that corporate value extends beyond financial metrics.

Moreover, in March 2024, the Commonwealth Climate and Law Initiative issued a legal opinion that expanded directors' duties to include nature-related risks alongside climate risks, further broadening the accountability landscape. In response, many organisations have introduced Sustainability Committees to oversee these areas, employing tools like scenario analysis to evaluate the strategic implications of environmental and social challenges.

Frameworks for High-Stakes Boards

CEO Performance Evaluation Methods

Relying solely on instinct and informal feedback for CEO evaluations is no longer enough. In 2024, CEO turnover reached a two-decade high - 20% of chief executives stepped down, with 42% of S&P 500 exits linked to poor shareholder returns. Yet, only 7% of boards fully utilise structured CEO assessments, highlighting a significant gap in evaluation practices.

A seven-step evaluation cycle introduces the necessary structure to this process. It starts with setting annual goals, followed by CEO self-evaluation, gathering 360° stakeholder feedback, synthesising and calibrating the findings, delivering results in an executive session, updating development plans, and securely documenting the outcomes. Boards that treat evaluation and succession planning as an ongoing process, rather than a one-off task, report 30% smoother CEO transitions.

To move beyond instinct, many modern boards are adopting evidence-based assessment frameworks. These include tools like psychometric tests, leadership judgement evaluations, behavioural event interviews, scenario simulations, and alignment analyses to assess organisational culture. As Annelize van Rensburg, Global Chair of Signium, notes:

Experienced directors still rely on their instincts, but they must be guided by more objective information. Rather than replacing intuition, evidence‐based assessment methods enhance how boards can apply their instincts.

A forward-thinking example comes from Standard Bank Group, which planned CEO and CFO retirements for 2025 and 2026 well in advance. Their appointments prioritised expertise in AI, cybersecurity, and digital risk, while also reviewing director independence under King IV and V frameworks. In volatile industries, mid-year performance reviews have proven effective in addressing potential issues before they become critical failures.

These structured frameworks not only improve evaluation processes but also create a foundation for more tailored advisory practices that strengthen board oversight.

Lessons from Bespoke Advisory Practices

Building on structured evaluation methods, bespoke advisory practices offer boards additional tools to enhance accountability. By addressing potential conflicts of interest, emotional biases, and unconscious behaviours, these tailored approaches help boards maintain objectivity. Many effective boards implement continuous induction programmes paired with annual professional development plans aligned to a board skills matrix.

Independent expert reports further support decision-making by flagging emerging risks, such as Responsible AI and vulnerabilities in supply chains. Kate Graham, Deputy Group Company Secretary at Aviva, underscores the importance of ongoing learning:

It's not the case of just doing the induction as a one-time activity, it's about what sort of continuous induction they need and whether that can be carried out collectively or individually.

External advisers also assist boards in prioritising decisions by categorising them into Strategy, Performance, People, and Governance, ensuring that long-term value remains the focus. Some boards adopt innovative practices, such as re-evaluating committee structures annually to retain only essential sub-committees. Others use techniques like appointing devil's advocates or dividing boards into opposing teams to challenge assumptions during high-stakes discussions.

Bespoke leadership advisory services, like those offered by House of Birch, focus on enhancing decision-making, emotional discipline, and strategic intelligence during critical moments. These services recognise that over 65% of CEOs cite balancing competing stakeholder interests as one of their most complex challenges. By coaching management teams to prepare concise board papers that highlight trade-offs and strategic context, advisers ensure directors can focus on informed decision-making without being overwhelmed by unnecessary detail. Such tailored insights, exemplified by House of Birch’s approach, reinforce the board’s ability to navigate high-pressure, strategic decisions effectively.

Conclusion

Key Takeaways for Leaders

Boards influence decision accountability not just by analysing data but by focusing on better decision-making processes. Research highlights that the quality of these processes is six times more impactful than the volume of analysis alone. This underscores the importance of how boards frame issues, question assumptions, and manage discussions, rather than relying solely on extensive data.

The most effective boards prioritise understanding the drivers behind decisions rather than getting stuck in the details of spreadsheets. Esmond Kensington, Head of Strategy and Chief of Staff at HSBC UK, explains:

As a board member, you're not here to challenge the numbers; you're here to challenge the drivers behind these numbers.

This mindset shifts the focus from basic compliance to outcome-oriented reporting, highlighting the tangible impact on strategic goals. By concentrating on the root causes of decisions, boards can pave the way for meaningful improvements.

To enhance accountability, boards should ensure every board paper clearly defines its purpose - whether it seeks visibility, input, or a decision. Following up with post-decision reviews helps evaluate both the quality of the decision and the process behind it. When problems arise, applying root cause analysis allows boards to explore why failures occurred, rather than merely identifying what went wrong.

For leaders navigating these complexities, expert advisory services like House of Birch offer valuable support. They focus on strengthening decision-making skills, maintaining emotional discipline, and cultivating strategic insight during critical moments.

Ultimately, strong board processes are essential for fostering accountability and driving organisational success. As noted by the Financial Reporting Council:

The boardroom is a place for robust debate where challenge, support, diversity of thought and teamwork are essential features.

FAQs

How can boards foster psychological safety to improve decision-making?

Psychological safety refers to the shared understanding among board members that they can express their thoughts freely, challenge ideas, and acknowledge mistakes without fear of criticism or repercussions. This kind of environment is crucial for better decision-making, as it promotes diverse viewpoints, highlights potential risks, and encourages creativity, enabling boards to break away from routine thinking and take responsibility for their decisions.

Creating psychological safety within a boardroom involves embracing diversity of thought, encouraging inclusive conversations, and establishing a culture where showing vulnerability is seen as a strength rather than a weakness. Simple practices such as regular informal check-ins, coaching, and peer-learning sessions can help build trust and ease the perception of the boardroom as an overly high-pressure setting. Additionally, behavioural methods like reversed-thinking or breaking down complex challenges into smaller, manageable parts can stimulate more forward-focused and innovative discussions.

For boards seeking a more tailored strategy, House of Birch provides customised leadership advisory services. Through coaching, workshops, and debrief sessions, they help leaders develop the emotional resilience and strategic insight necessary to nurture openness and enhance the quality of decision-making.

How can boards ensure CEOs are held accountable for their decisions?

Boards play a crucial role in ensuring CEOs are held accountable and aligned with organisational goals. One effective tool is a written performance contract, which translates strategic objectives into clear, measurable key performance indicators (KPIs). Linking a portion of the CEO’s pay - such as bonuses or equity awards - to these KPIs creates a direct incentive to achieve defined targets.

Specialised committees, like remuneration and audit committees, are vital for ongoing oversight. These groups should regularly evaluate performance across both financial and non-financial metrics, such as environmental, social, and governance (ESG) outcomes. Annual board-led performance reviews provide a structured opportunity to assess the CEO’s progress, allowing for timely adjustments or even succession planning if needed. Decision-paper processes also add rigour by requiring major proposals to be reviewed for their rationale, associated risks, and anticipated results.

Integrating these practices into a board’s routine - such as scheduling quarterly KPI reviews and annual strategic assessments - ensures a transparent and consistent accountability framework. For boards seeking expert guidance, House of Birch provides tailored advisory services to help implement these systems, improving leadership oversight and decision-making at the highest level.

How are boards addressing societal and environmental accountability in decision-making?

Boards are increasingly acknowledging the importance of addressing societal and environmental challenges as part of their core responsibilities. In Europe, the rise of double-materiality assessments is pushing organisations to source reliable sustainability data to guide their strategies and investment choices. Many boards are responding by forming ESG or climate-focused committees, tying executive compensation to specific sustainability targets, and emphasising long-term value through environmentally and socially responsible initiatives.

In the UK, boards are broadening their expertise by adopting comprehensive climate governance frameworks and making stakeholder engagement a regular feature of their discussions. Specialist advisory firms, such as House of Birch, play a key role in supporting leaders, helping them sharpen their decision-making and enhance their strategic insight on these issues. By embedding these approaches, boards can align their purpose with profitability, foster trust, and ensure sustainability remains central to their decision-making processes.